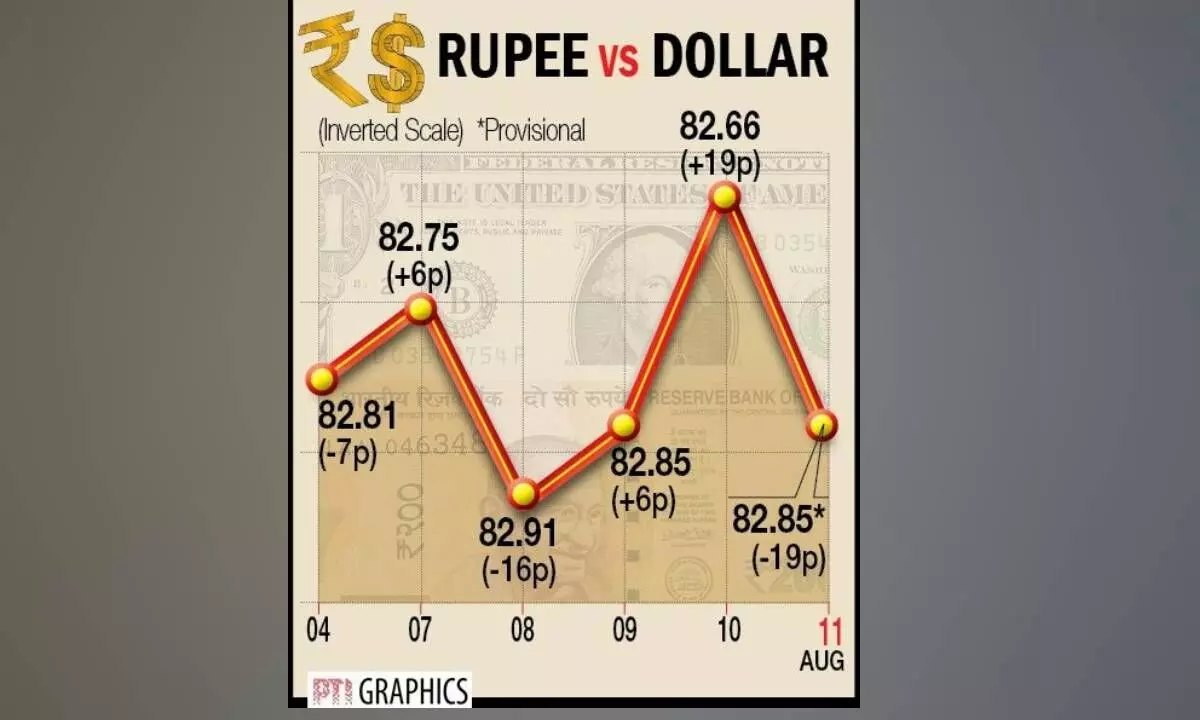

Re down on weak domestic cues

The local unit sheds 19 paise to 82.85/USD

image for illustrative purpose

Mumbai The rupee depreciated by 19 paise to settle at 82.85 against the US dollar on Friday amid weak sentiment in the equity markets and a strong dollar against major rivals overseas.

Foreign fund inflows and softening crude prices, however, supported the Indian currency even as investors were awaiting India’s industrial output number, to be released on Friday, said analysts. At the interbank foreign exchange market, the local unit opened at 82.75 against the US dollar. It touched the peak of 82.73 and hit the lowest level of 82.87 during intra-day trade before settling at 82.85 against the greenback, 19 paise lower from its previous close. “Indian rupee depreciated on a positive US dollar and weak domestic markets. However, FII inflows and overnight decline in crude oil prices cushioned the downside,” Anuj Choudhary, Research Analyst at Sharekhan by BNP Paribas, said.

On Thursday, the rupee rebounded 19 paise to close at 82.66 against the US dollar after the RBI asked banks to set aside a larger part of incremental deposits under the cash reserve ratio (CRR) as part of measures to take out excess liquidity from the banking system. The Reserve Bank of India in its bi-monthly monetary policy review also decided to keep key interest rate unchanged, but hinted at tighter policy if food prices drive inflation higher. In the overseas currency market, the dollar strengthened after US consumer price inflation showed moderation in July, raising hopes that the US Federal Reserve would pause rate hike. Choudhary said the rupee is expected to trade with a “negative bias on risk aversion in global markets and elevated crude oil prices. However, fresh inflows by FIIs may support Rupee at lower levels. Traders may take cues from India’s industrial production and US PPI and consumer sentiment data.